This guide explores how credit card surcharges became Marcus’s solution—and how they might work for your business too.

What exactly is a credit card surcharge?

A credit card surcharge is a transparent fee added to customer transactions when they choose to pay with a credit card. Think of it as cost recovery rather than profit generation—it’s designed to help businesses offset the actual expenses of accepting credit card payments, including interchange fees, assessment fees, and processor markups.

The hidden cost crisis: why credit card surcharges matter more than ever

The staggering numbers behind payment processing

The scale of this challenge is massive: US merchants paid over $148.6 billion in credit card processing fees in 2024 alone. To put that in perspective, that’s more than the entire GDP of Morocco or Ecuador. For individual businesses, these fees typically consume 1.5% to 3.5% of each transaction, with premium rewards cards demanding even steeper tolls.

Consider this real-world example: A company processing $1.2 million in annual invoice payments discovered that credit card fees were costing them more than $40,000 annually—enough to fund significant operational improvements.

Breaking Down the True Cost of Acceptance

| Fee Component | Typical Range | Real-World Example (on $10,000 invoice) | Annual Impact* |

|---|---|---|---|

| Interchange Fees | 1.15% – 3.00% | $295 | $35,400 |

| Assessment Fees | 0.13% – 0.15% | $15 | $1,560 |

| Processor Markup | 0.25% – 1.00% | $50 | $6,000 |

| Monthly/Fixed Fees | $35 – $50 | $35 monthly gateway fee | $420 |

Total annual processing costs: $43,380

*Based on $1.2M annual processing volume

Given this substantial financial burden—often tens of thousands of dollars annually—it’s entirely understandable why businesses increasingly choose to transparently allocate these costs rather than absorb them into already-strained profit margins.

Navigating the legal landscape: are credit card surcharges legal?

The short answer? It depends. The regulatory landscape for surcharges resembles a complex patchwork, with each state taking its own approach to balancing merchant rights and consumer protection.

Surcharge policies by state

Complete prohibition states: where surcharges remain off-limits

Connecticut takes the strongest anti-surcharge stance but cleverly allows cash discount programs when properly disclosed. Merchant strategy: Display credit prices as standard, offer cash discounts prominently.

Massachusetts prohibits traditional surcharges but permits a “dual-price system” where both cash and credit prices must receive equal prominence. Example: Cash Price: $1,000.00 | Credit Price: $1,035.00

Maine maintains a complete ban with no workarounds, forcing merchants to absorb costs entirely—even on large invoice payments.

Puerto Rico prohibits surcharging across all business types and payment methods.

States with conditional restrictions

Colorado allows maximum 2% surcharge and requires disclosure at point of sale and on receipts.

New York requires merchants to display total price including surcharge (not just the percentage).

Florida mandates exact surcharge amount disclosure before transaction completion.

The surcharge-friendly majority

Most states (42 total), including major business hubs like California, Texas, Illinois, and Virginia, allow credit card surcharges on all transaction types. This creates significant opportunities for invoice-based merchants to transparently pass processing fees to customers.

Card network rules for credit card surcharging

Visa

Visa requires written notice exactly 30 days before implementing surcharges on any payment method, including invoice systems. Your surcharge cannot exceed 3% or your actual processing cost, whichever is lower. Debit cards, prepaid cards, and gift cards remain off-limits for surcharges, even when processed through credit networks.

Mastercard

Mastercard mirrors Visa’s requirements across all payment channels but adds “mystery shopper” programs that may test invoice payment processes. Non-compliant merchants face swift penalties, making adherence crucial.

American Express

Amex maintains non-discrimination provisions that can complicate invoice surcharging, particularly for businesses accepting multiple card types. Some invoice-based businesses find it simpler to exclude Amex from surcharge programs entirely.

Essential invoice-specific compliance requirements

- Surcharge disclosure must appear before payment submission, not just on the invoice

- Payment gateway integration must calculate surcharges in real-time

- Emailed receipts must show surcharges as separate line items

- Multi-state businesses must customize surcharge application based on client location

Maintaining customer relationships while implementing surcharges

Research indicates that 19% of customers may consider switching payment methods when faced with surcharges. Here’s how successful merchants maintain positive relationships:

Offer alternatives: Provide low-cost options like ACH transfers alongside credit card payments.

Sweeten the deal: Early payment discounts or loyalty customer rewards can offset surcharge concerns while improving cash flow.

Stay compliant: Maintain detailed records of actual processing costs, as audits can occur years after implementation.

Is surcharging right for your business?

Credit card surcharging represents a powerful tool for cost recovery, but success requires proper implementation and ongoing management. The merchants who thrive share common traits: they view surcharges as transparent cost allocation rather than profit centers, they invest in appropriate technology, and they maintain an unwavering focus on compliance.

For businesses ready to take control of their payment processing costs, surcharging offers a viable path forward. The key lies in navigating the complexity with precision, transparency, and genuine customer focus.

How does Skyline Payments help our customers navigate credit card surcharging while staying compliant

Credit card surcharging can help businesses offset processing costs, but navigating the complex web of state regulations and compliance requirements can be challenging. Skyline Payments provides comprehensive tools and features designed to keep your business compliant while maximizing the benefits of surcharge programs.

Navigate surcharge regulations with precision

Credit card surcharge laws vary significantly across states, creating compliance challenges for businesses operating in multiple jurisdictions. Rather than forcing merchants to choose between blanket surcharge policies or manual compliance tracking, Skyline Payments allows customer-level controls that ensure full regulatory compliance while maximizing fee recovery in permitted states.

Transparent fee disclosure and payment choice

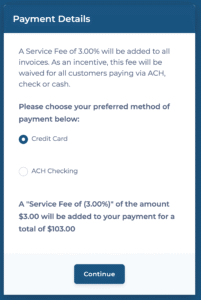

Legal compliance starts with proper fee disclosure. Skyline Payments ensures customers can see all surcharge fees before completing their payment through a self-service payment portal that displays total costs upfront. This transparency reduces confusion and meets legal disclosure requirements.

Equally important is providing customers with fee-free alternatives. The platform ensures alternative payment methods like ACH are always available, giving customers the choice to avoid surcharges entirely while still paying their invoices in full.

Cash discount options

For businesses in states with strict surcharge regulations, Skyline Payments offers cash discount programs as a compliant alternative. Instead of adding fees to card transactions, this option offers discounts for cash, check, or ACH payments. This approach is more widely accepted across jurisdictions and helps businesses offset processing costs while maintaining full compliance.

Debit card compliance

Skyline Payments can automatically detect debit cards in invoice payments and exempts them from surcharges to ensure compliance. This eliminates the need for businesses to manually verify card type while protecting them from regulatory violations.

Automated financial management

Manual reconciliation of surcharges can lead to errors and compliance issues. Skyline Payments eliminates this risk through automated transaction syncing that:

- ✓Creates surcharges as separate line items on invoices for clear tracking

- ✓Automatically categorizes surcharges correctly in your financial records

- ✓Maintains accurate books without manual intervention

- ✓Provides seamless ERP integration for streamlined accounting

Complete record keeping

Compliance extends beyond the initial transaction. Skyline Payments maintains comprehensive records of payment activities, including who, when and how much. This automated record-keeping system ensures you have the necessary information to oversee your surcharging environment.

Conclusion

Credit card surcharge programs can provide significant benefits to businesses, but only when implemented correctly. Skyline Payments removes the complexity and risk from surcharge management through automated compliance features, transparent fee structures, and comprehensive record-keeping. By handling the technical and regulatory details, Skyline Payments allows you to focus on growing your business while staying fully compliant.

Ready to take control of your payment processing costs?